This article provides a summary of the report titled “California Landscape of Climate Finance” published by the Climate Policy Initiative (CPI). The report examines the current state and future investment needs of California to meet its climate goals. Key points from the report include:

- California has enacted several climate change laws, including carbon neutrality and a reduction in carbon emissions by 2045.

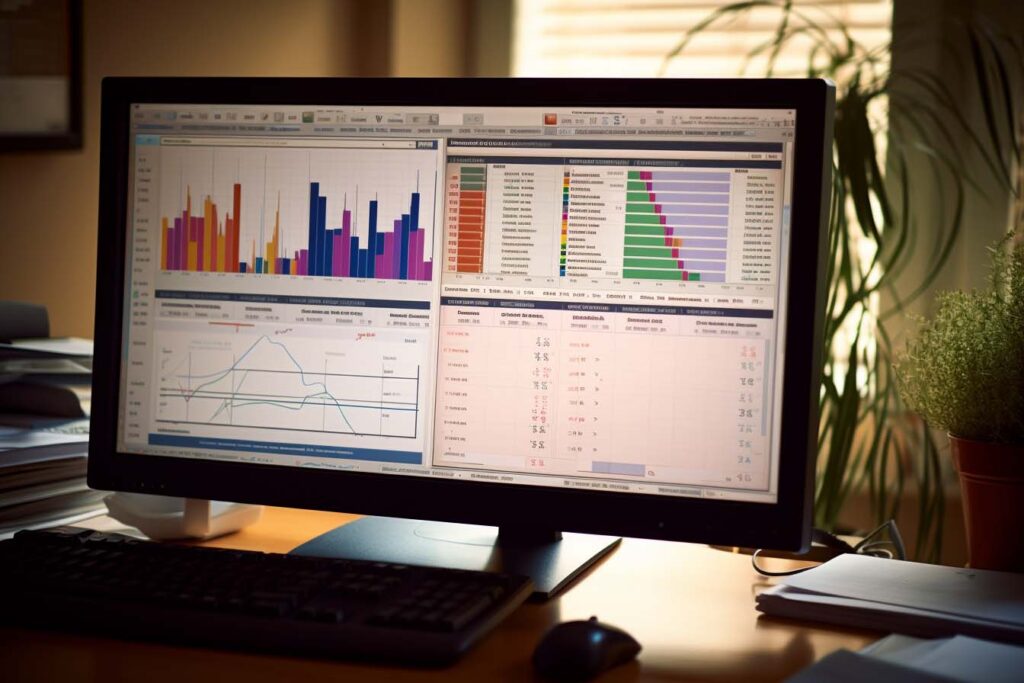

- CPI created a comprehensive analysis of climate finance in California to support policymakers and private sector actors in identifying opportunities and establishing priorities.

- CPI estimates that California will need an annual average of $62 billion from 2023 to 2035 to meet its climate goals, with investments in zero-emission vehicles, energy systems, agriculture and land use, and buildings and infrastructure.

- CPI tracked $39 billion of climate finance spending in 2022, representing 63% of the annual needs through 2035.

- The growth of private sector spending in climate finance is encouraging, but further mobilization of private sector investment is needed to close the funding gap.

- Climate finance is distributed relatively evenly per capita by county, but there is a need to channel more funding to areas with higher pollution metrics.

- The report provides recommendations for policymakers, civil society, and the private sector to close the climate investment gap, including developing a comprehensive roadmap, tracking policy impact, and identifying opportunities for public and concessional funds to have a larger impact.

The report suggests that a full landscape of California climate finance could provide improved decision-making and prioritization for policymakers, development banks, and philanthropies. Additional topics that could be covered in a full landscape include tracking of climate finance in additional sectors and actors, needs assessment for sectors without clear decarbonization pathways, capacity building, and regional and sub-county tracking of climate finance.